Context

Money Fellows is a financial technology (fintech) company based in Cairo, Egypt. It offers a platform that facilitates rotating savings and credit associations (ROSCAs), also known as "gameya" in Arabic. ROSCAs are traditional savings groups where members contribute fixed amounts of money regularly, and each member receives a lump sum payout in rotation.

Money Fellows aims to modernize and digitize the traditional ROSCA model, making it more convenient, transparent, and accessible to users through its online platform and mobile application. The platform allows users to create or join savings circles, contribute funds, and receive payouts according to a predetermined schedule. By leveraging technology

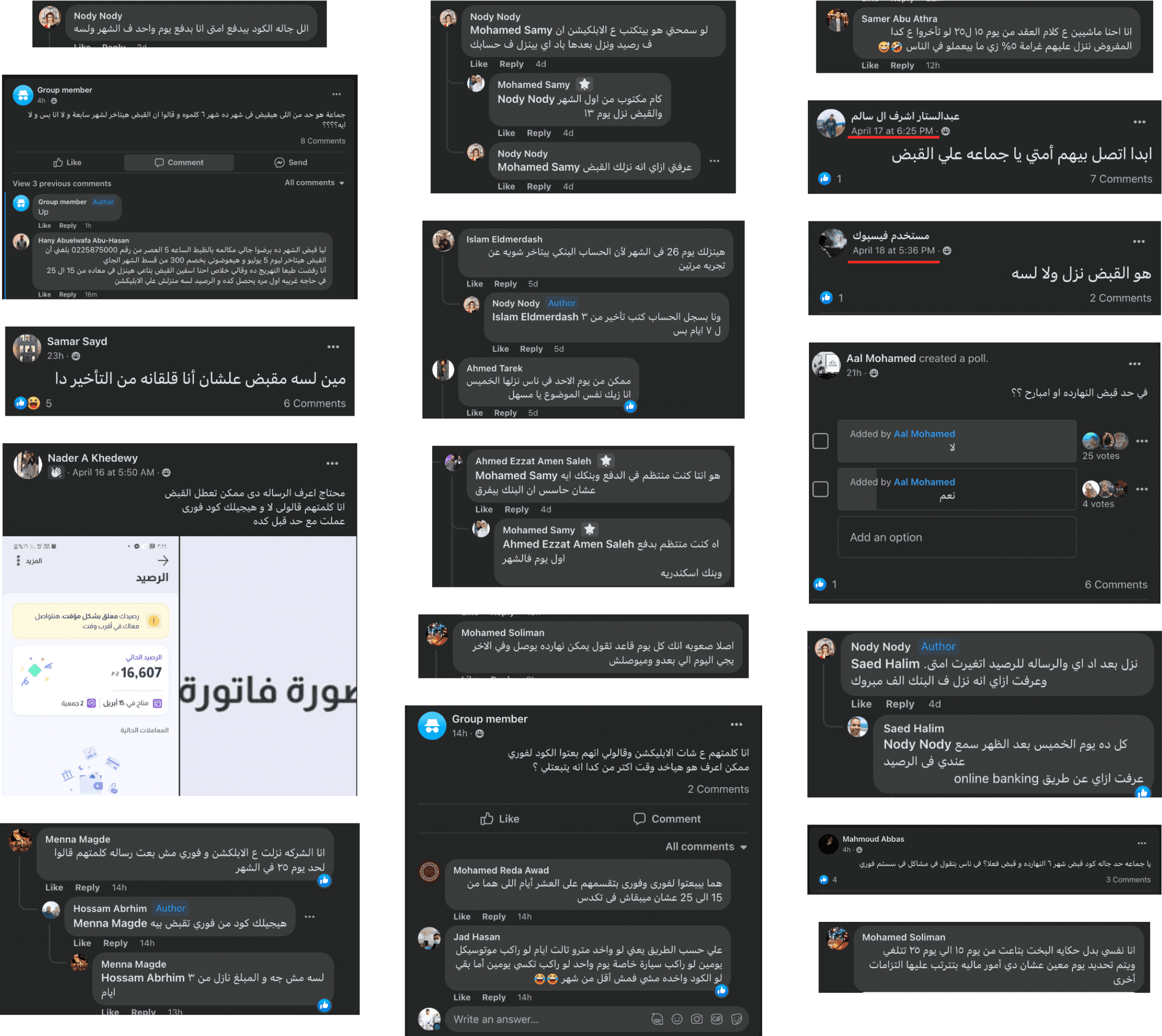

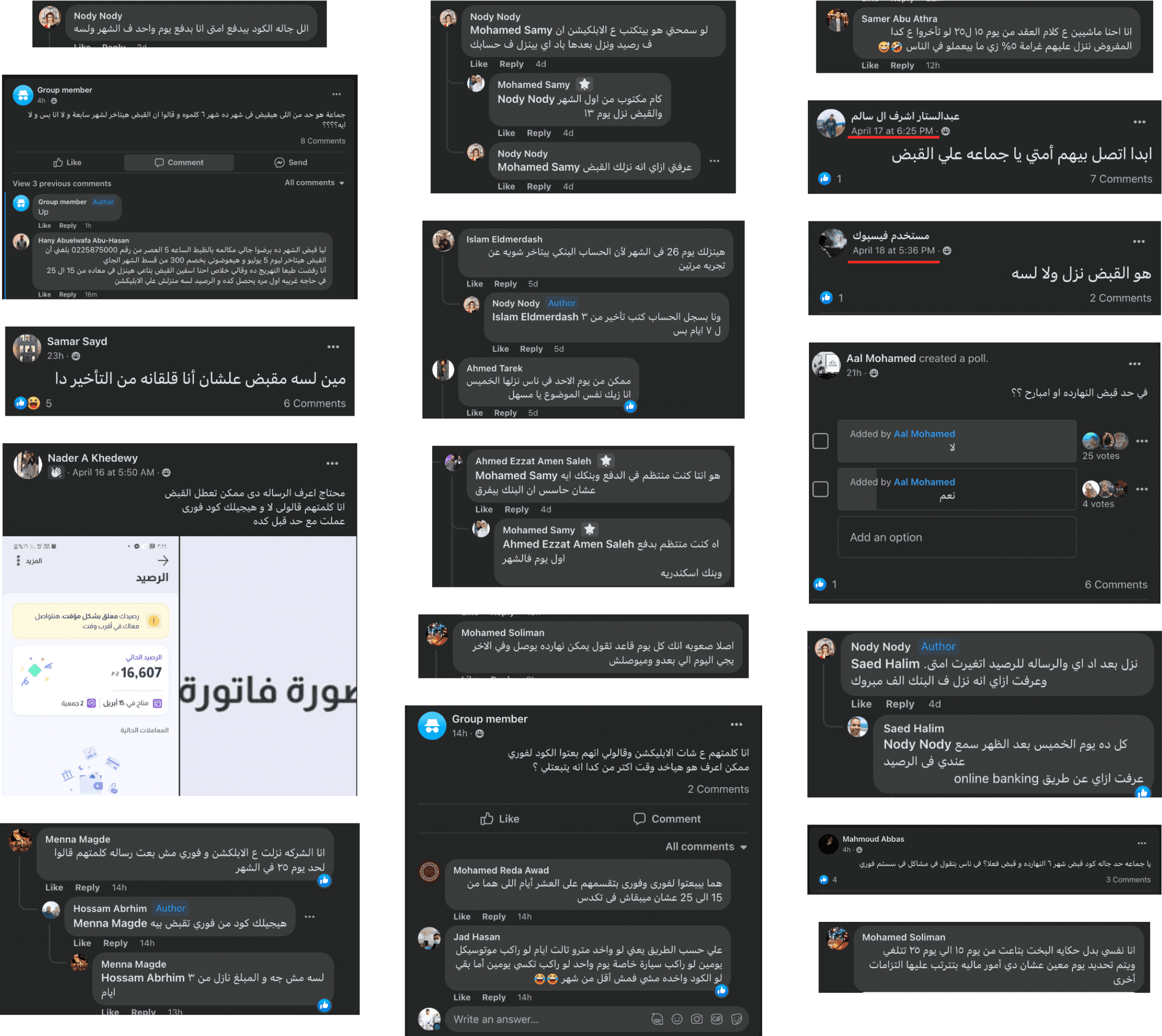

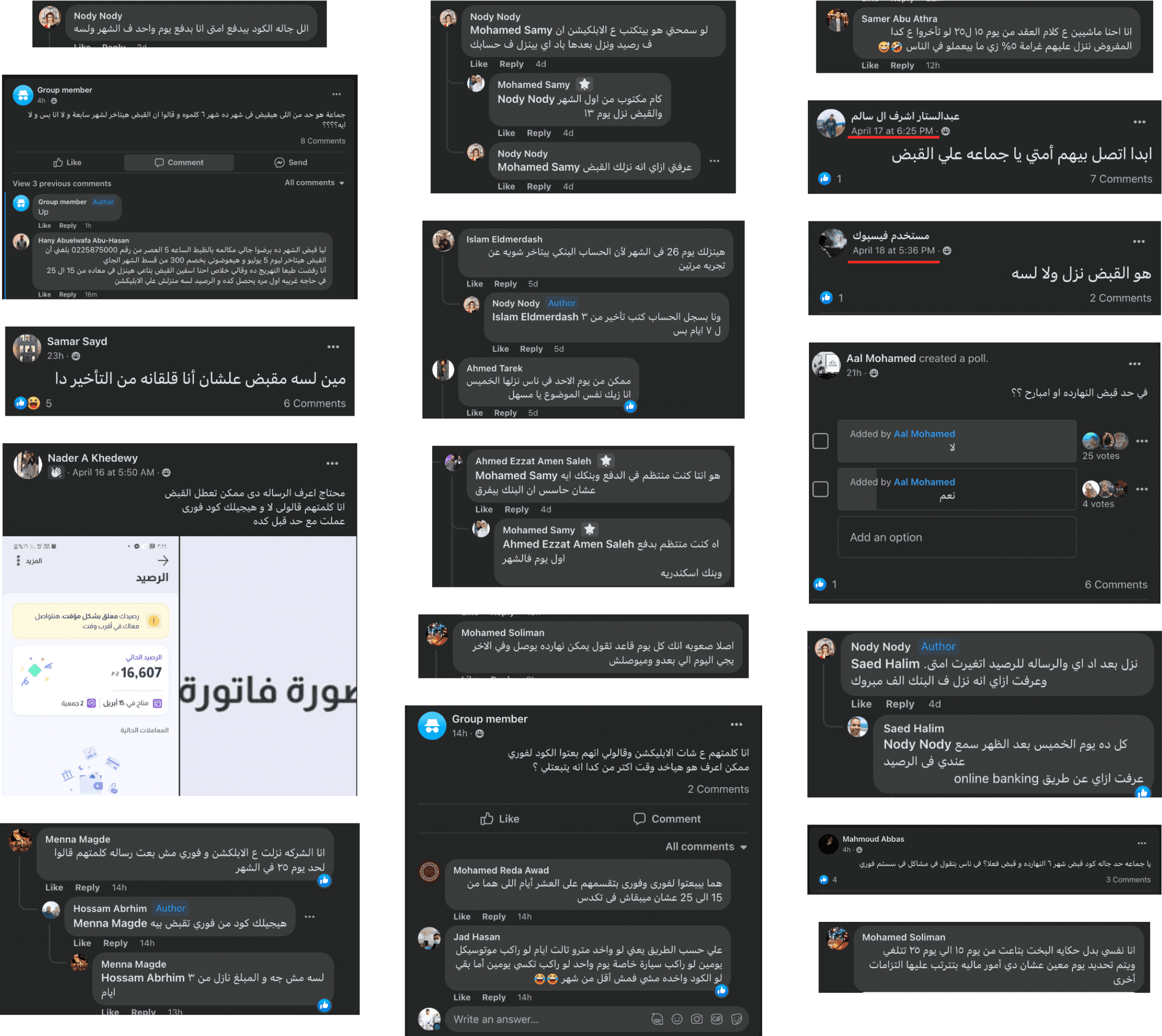

Problem

Users were complaining about their payout, and it’s date! As we can tell, the payout date isn’t well defined/specified, neither from the company, nor the contract.

Users are seeing this unfair to be requested to pay their pay-ins in their first 5 days of the month, and they receive

their money in the latest days in the month, I stand with our users on that!

Goal:

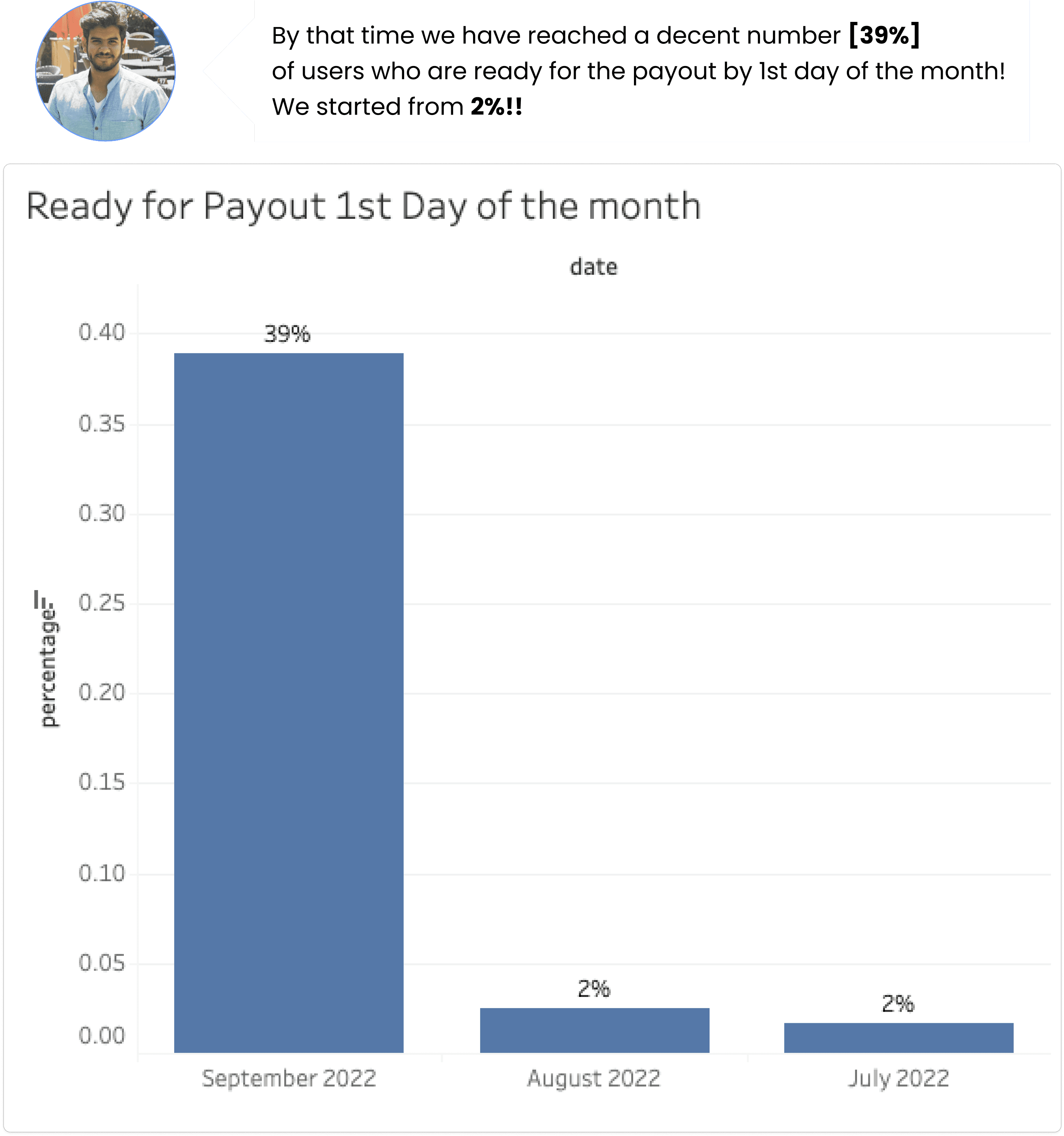

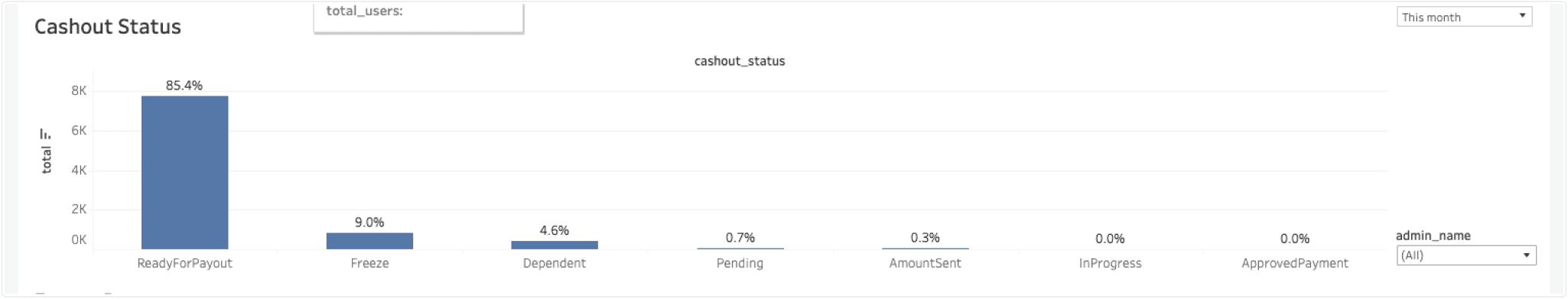

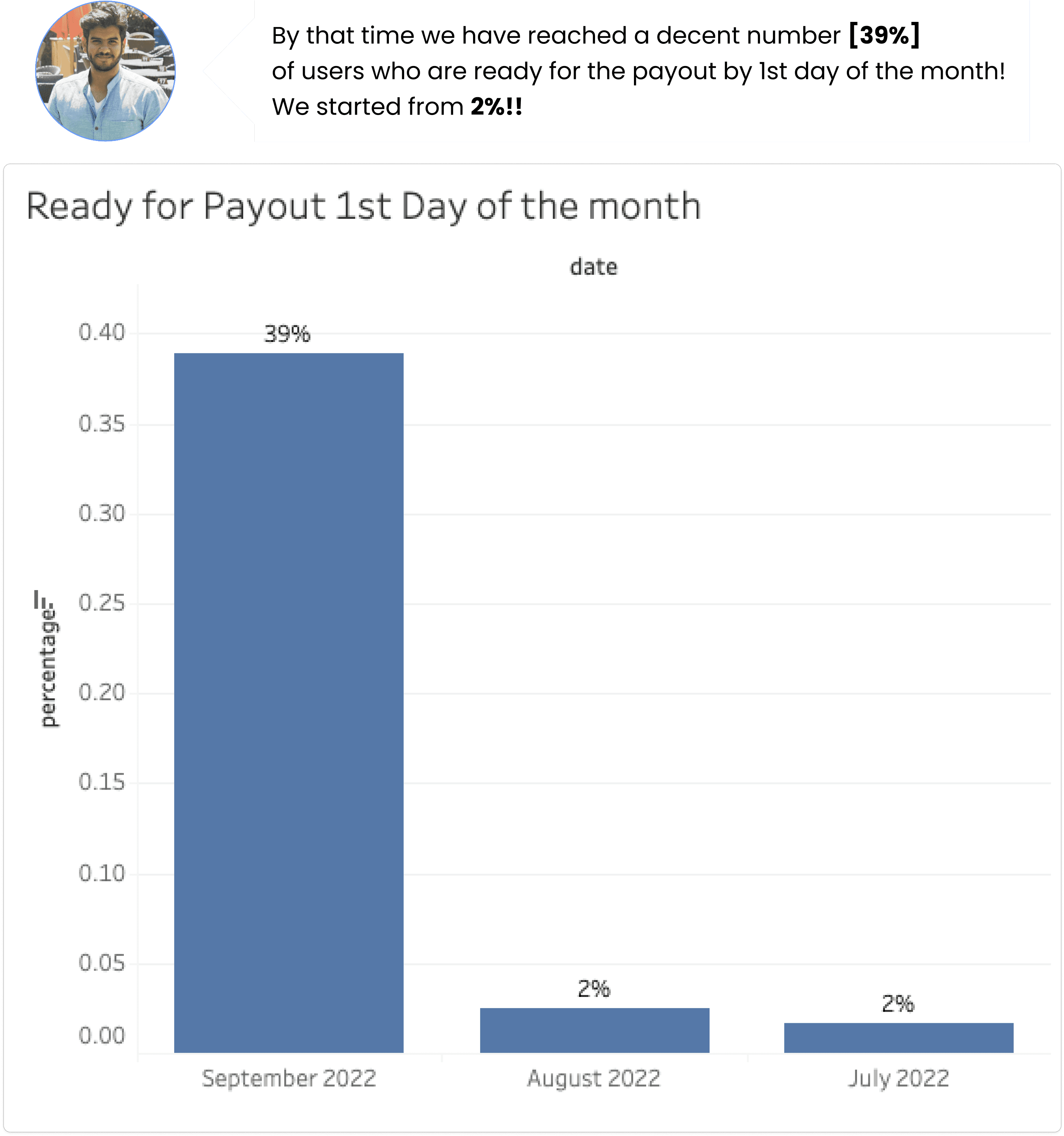

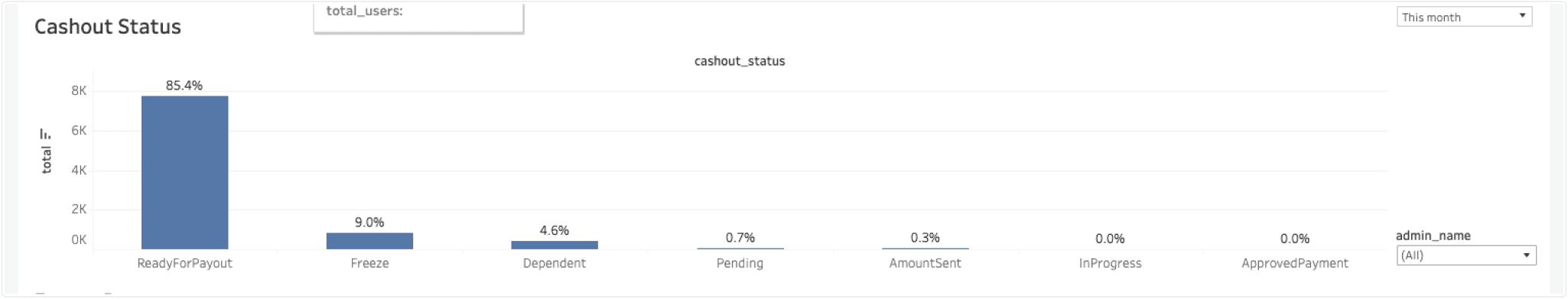

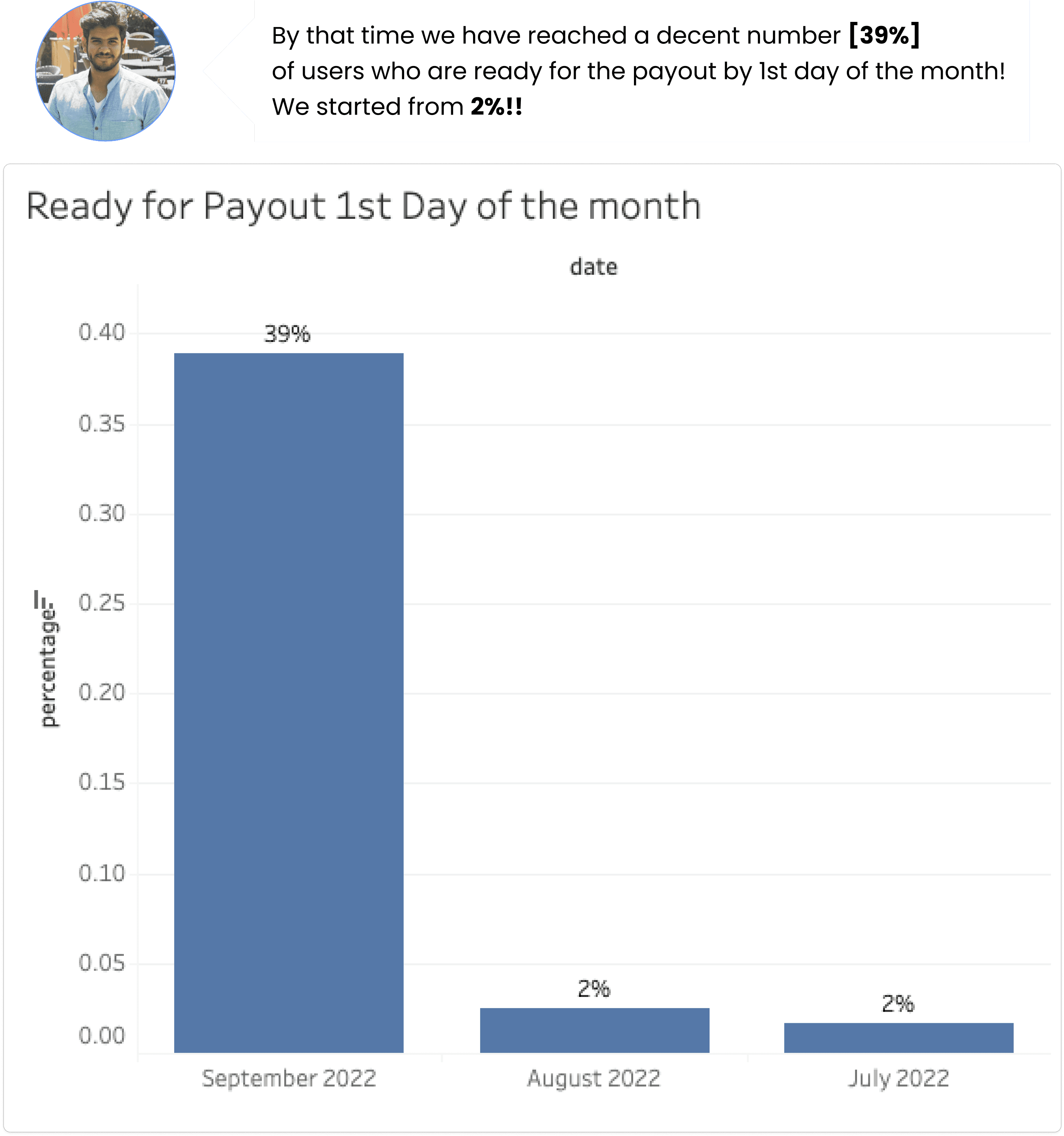

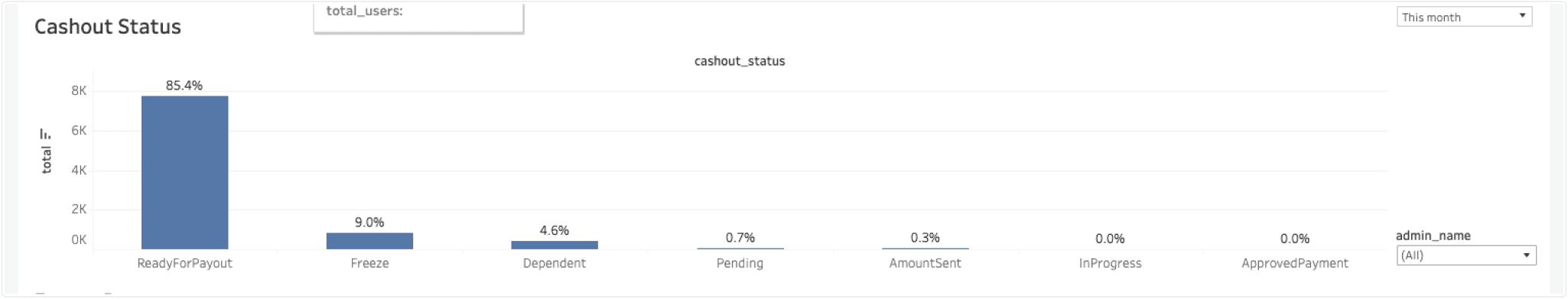

Increase users who are ready for payout at the first day of the month by 20%, the current number is 2% [May-July 2022]

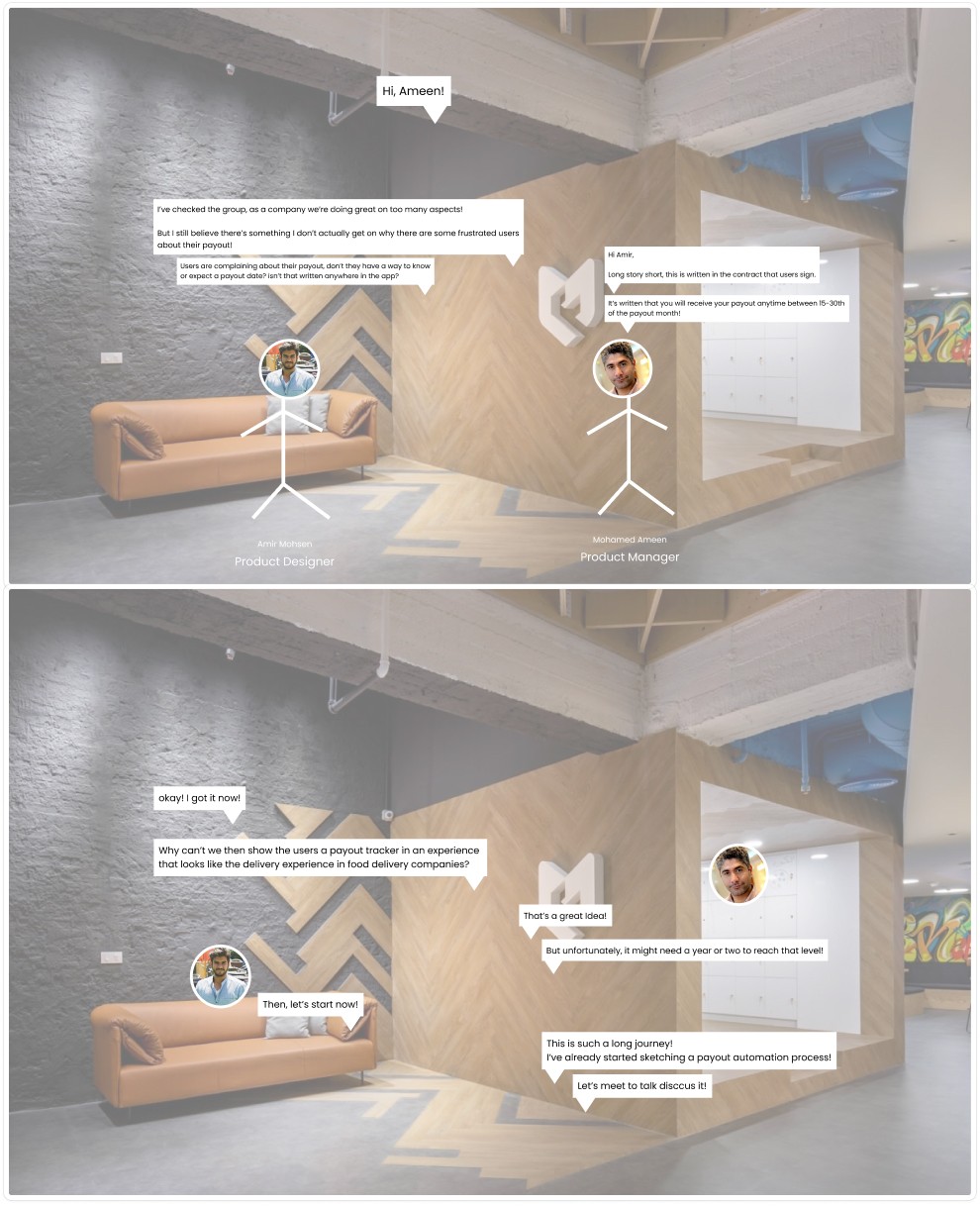

-> Back then, Ameen - The Product Manager - has told me that we have technical limitations and we do a lot of manual work. We sat together and agreed on a plan to avail a status tracker and make the experience better on this aspect, we agreed that we need to tackle the following issues:

Plan (10-12 months):

Setting Expectations with clear communication through the app

Payout Automation Process that can automate most of the manual work

A faster and more effective way to let the operations payment team do their job

A status tracker to track the payment

Automate the finance process to include those who couldn’t receive their payout

Data Analysis:

As a product team we do like including the squad members early in the design process and the decision making process, that is even before the Squad playback or the Design Critique

We all agreed that the payout is the most critical point in our experience, we shared the plan with them, and we started moving forward

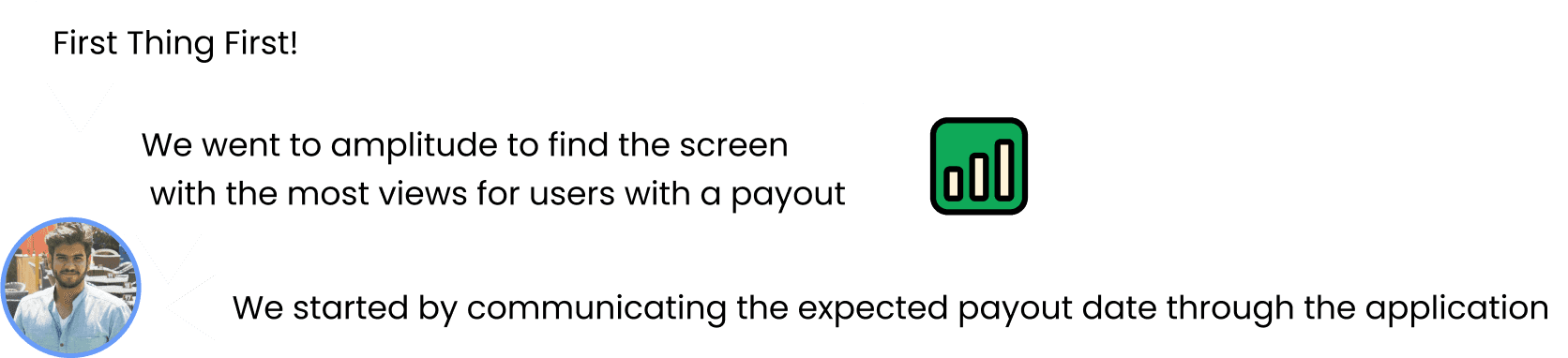

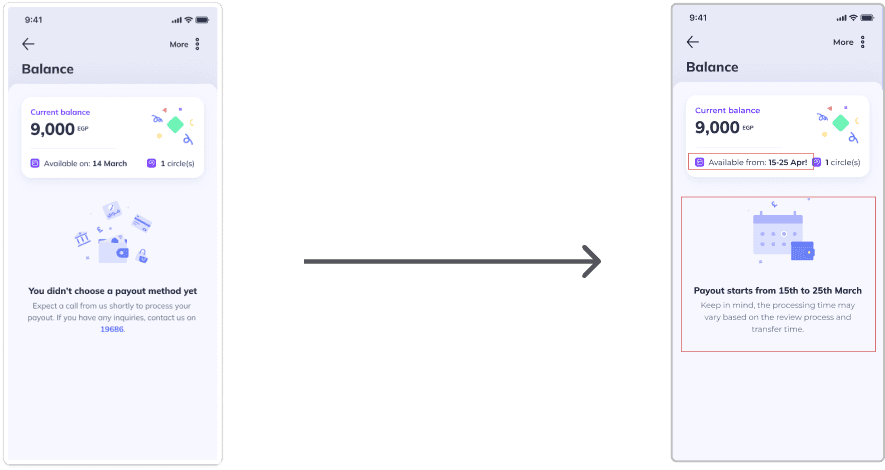

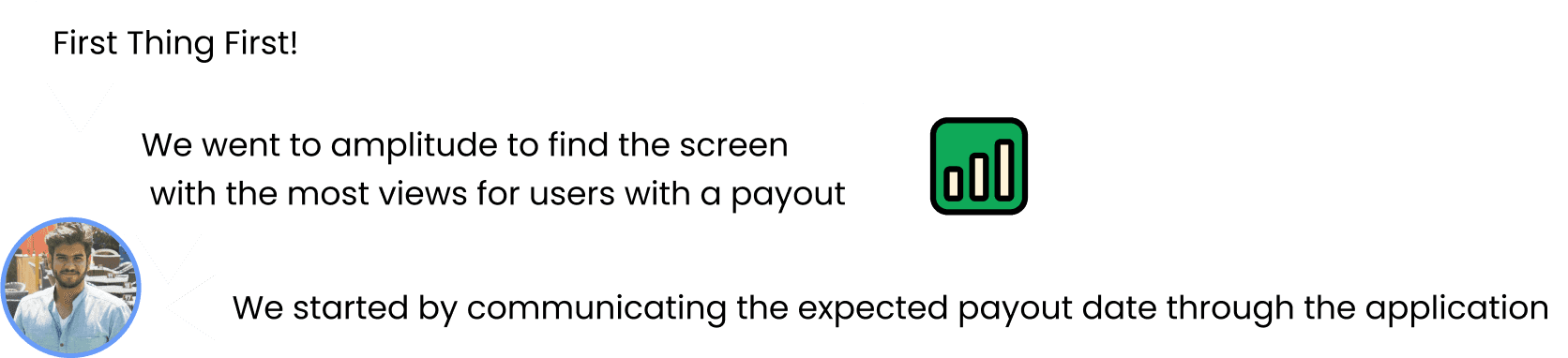

1- Setting Expectations with clear communication through the app

This has raised the awareness, and we started noticing people in the comments taking a screenshot

of the empty state and spread it out to let users that this normal and no need to panic

- The curve started to flatten and the spike in calls was gone already! ⭐️

2- Payout Automation Process

At that stage, the product team started thinking about having personas based on user behaviors, so we started creating Service Blueprint

This was super helpful in the payout automation process as it would show us the pain points and where can we automate some of our processes to enhance the payout experience

We have invested so much time on this, We had interviews with almost different departments, 3rd parties, banks and even couriers, this has taken almost a Quarter to finish the service blueprint in the Payments Squad

🛑 We have struggled with:

Trying to get available time slots with stakeholders

Sometimes, they even delegate the meeting to someone who isn’t up-to-date with the new process this has caused so much rework

Some updates were happening while we are interviewing some others

🍀 But we tried to be proactive, and learn from our mistakes, we also documented everything so we can update ourselves and the requirements to stay on track.

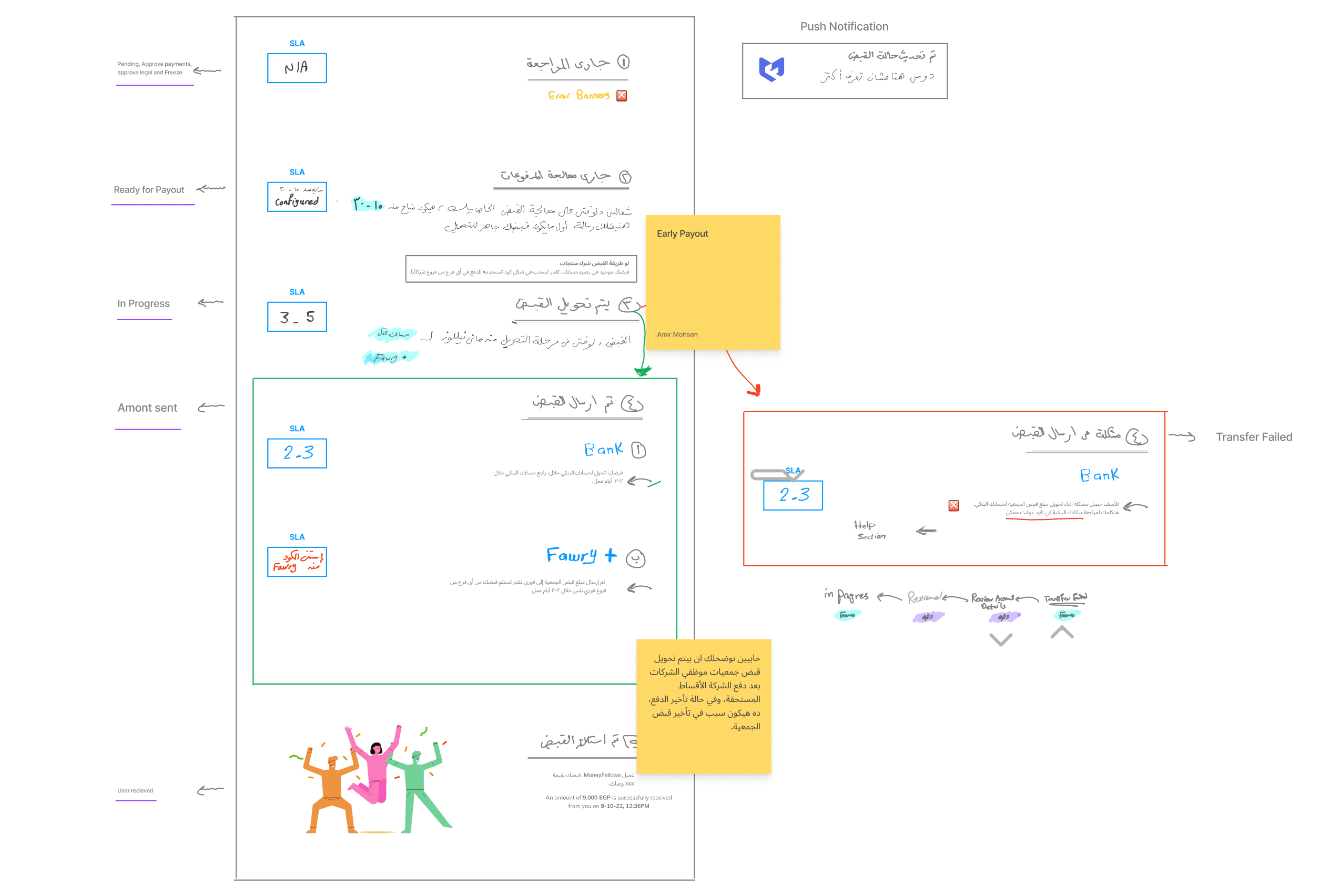

I will include the service blueprint for the payout process only, but I have worked on each flow in my scope, Here’ you can find the whole as-is scenario for the payout:

Before:

After:

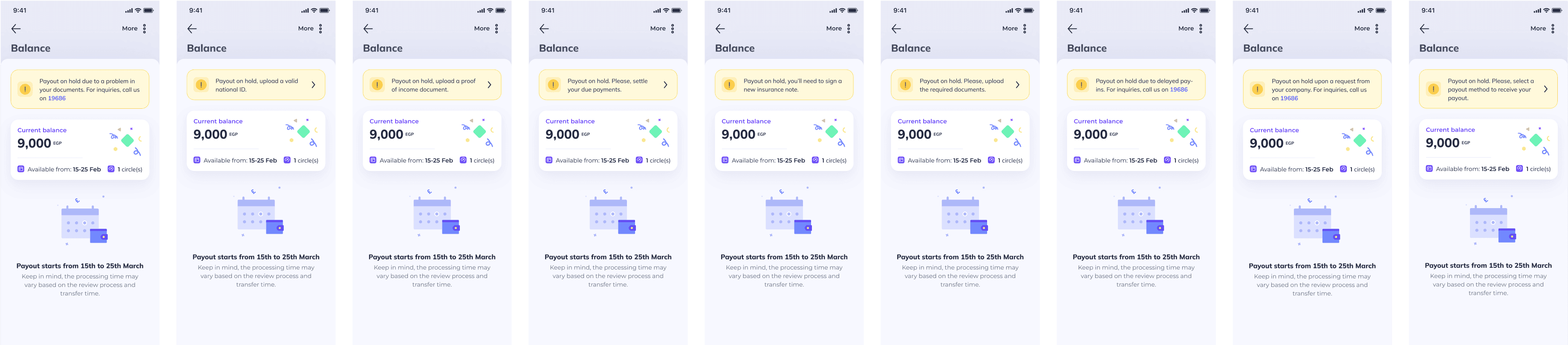

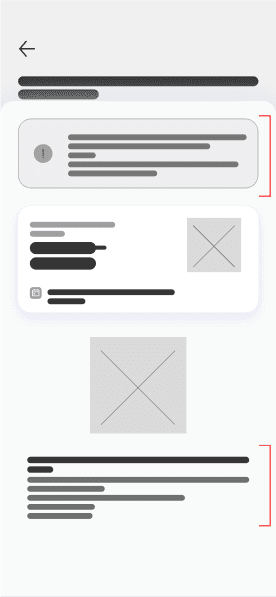

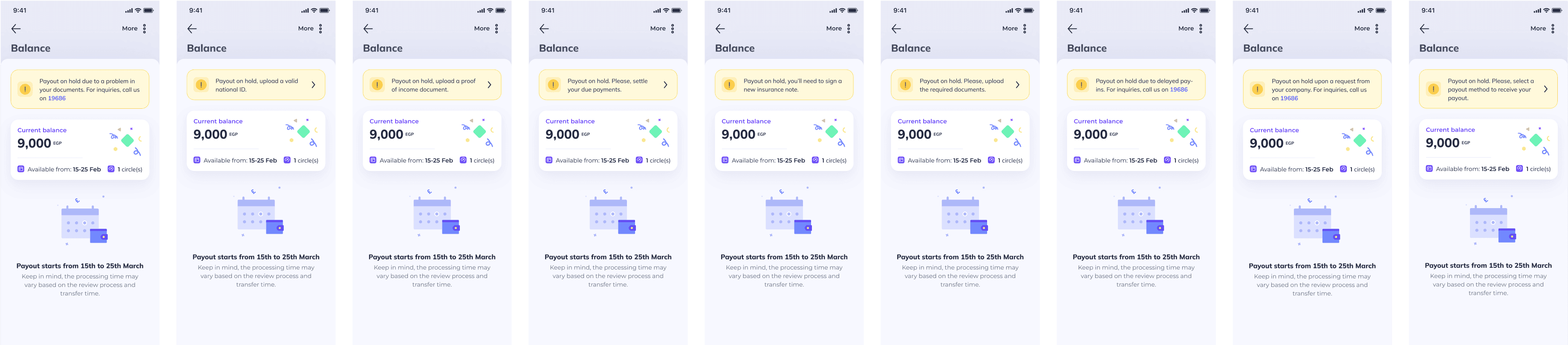

I relied on the usability heuristics while designing the solution!

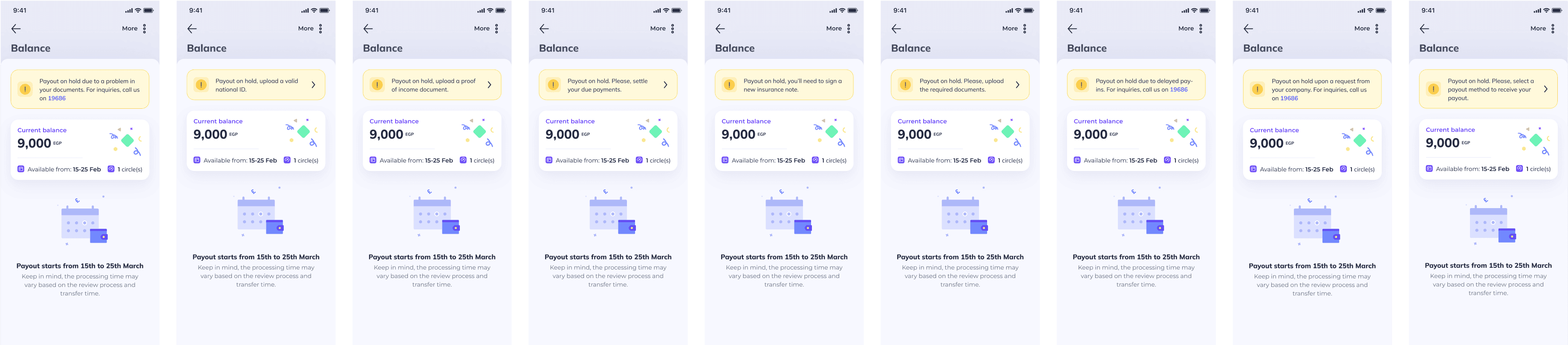

Wireframes & UI:

Data Tracking Events [Added] ✅

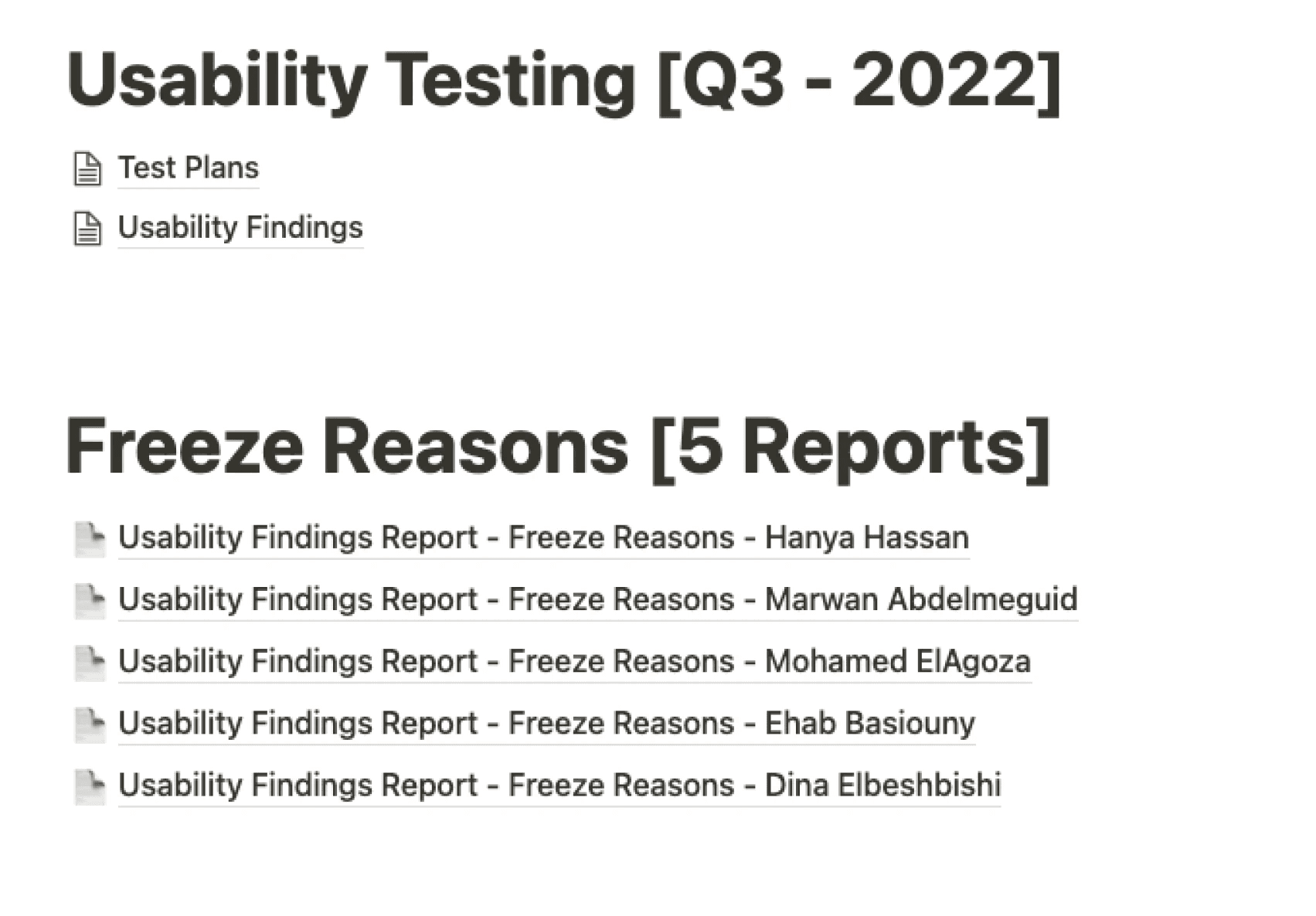

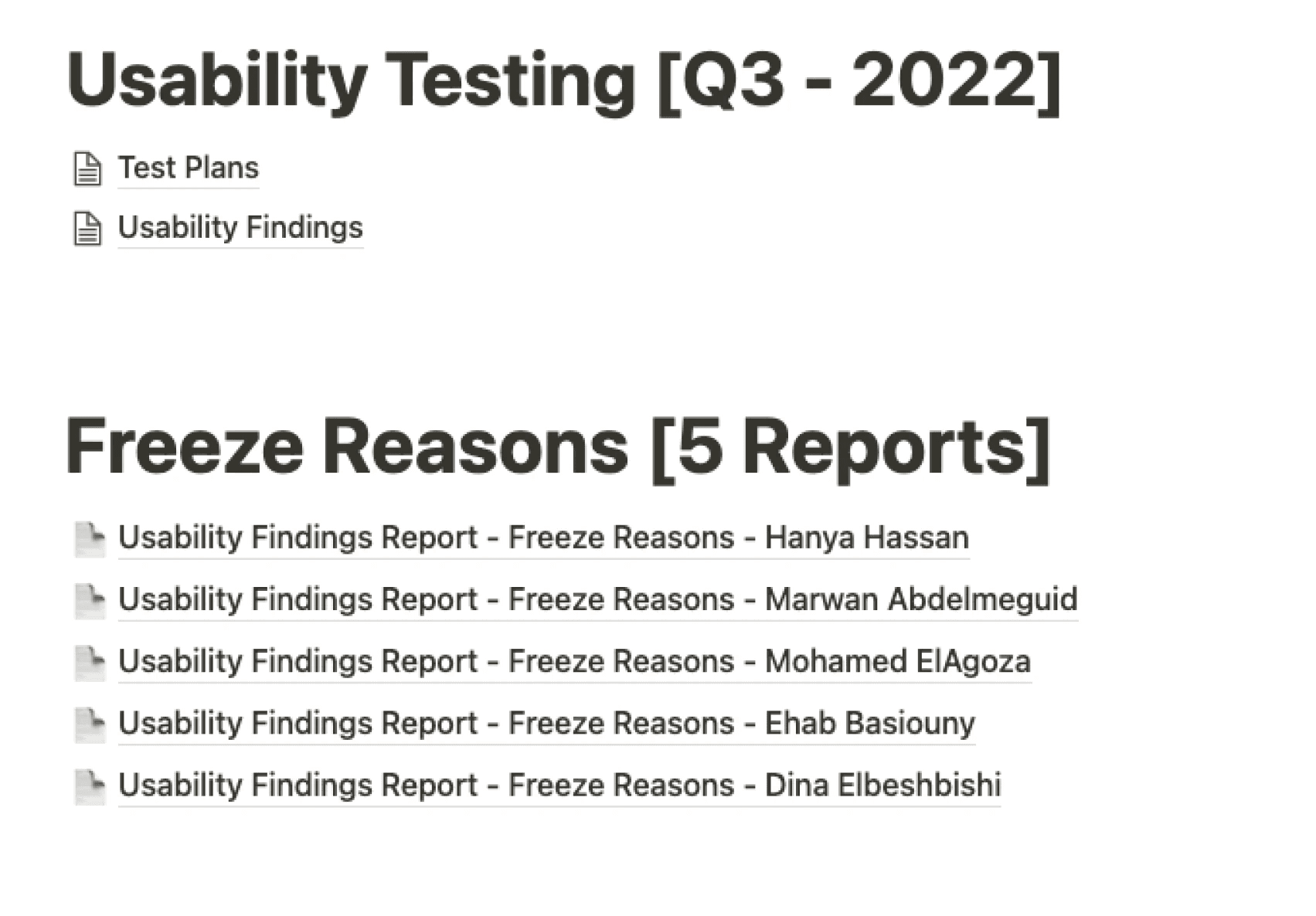

Prototyping & Testing:

Some minor changes have appeared in the usability tests, and we applied them to launch 🚀

We started seeing results!

Number of users who are ready to cashout at the 1st day of the month has increased from 2% to 39%!

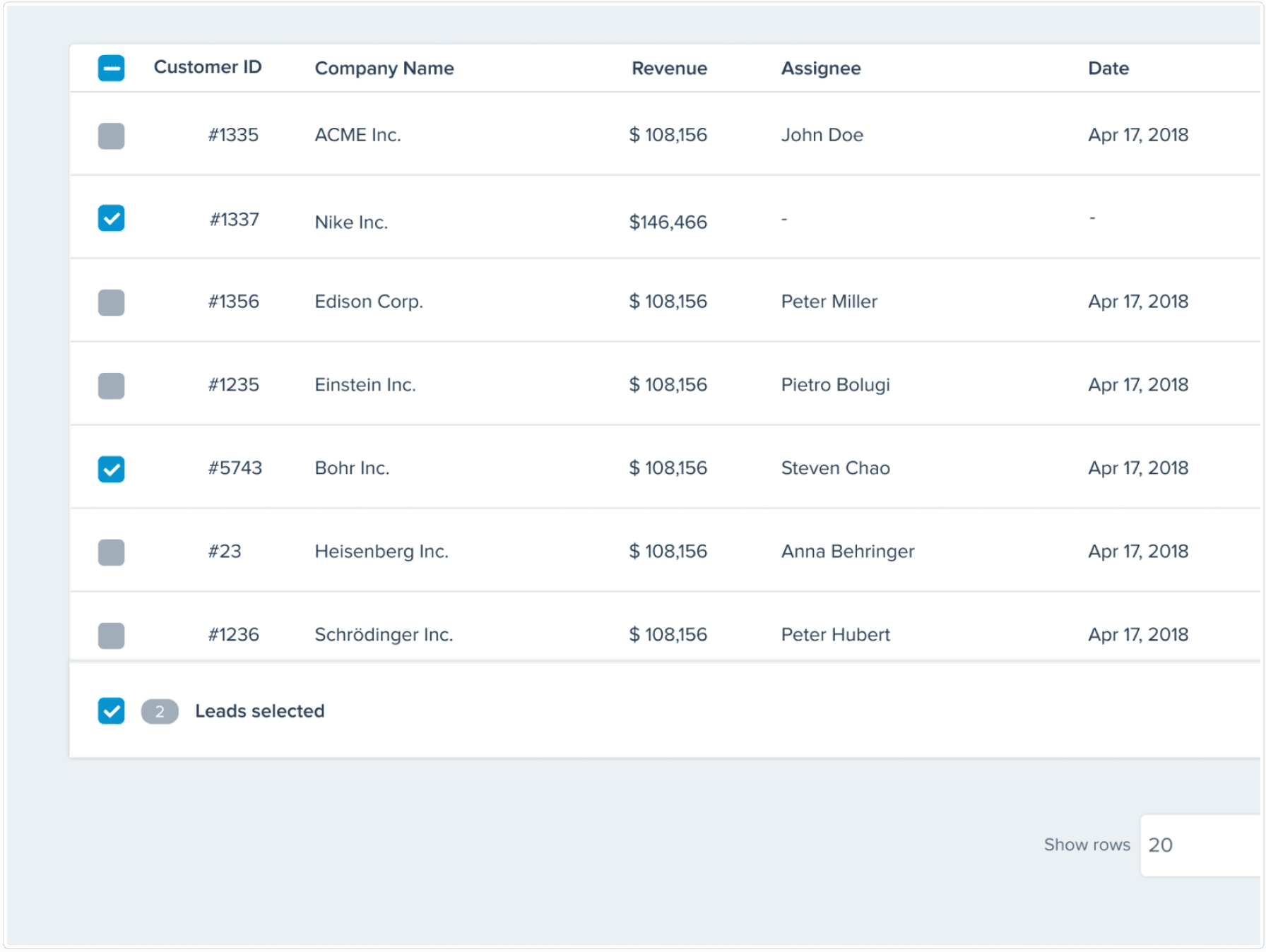

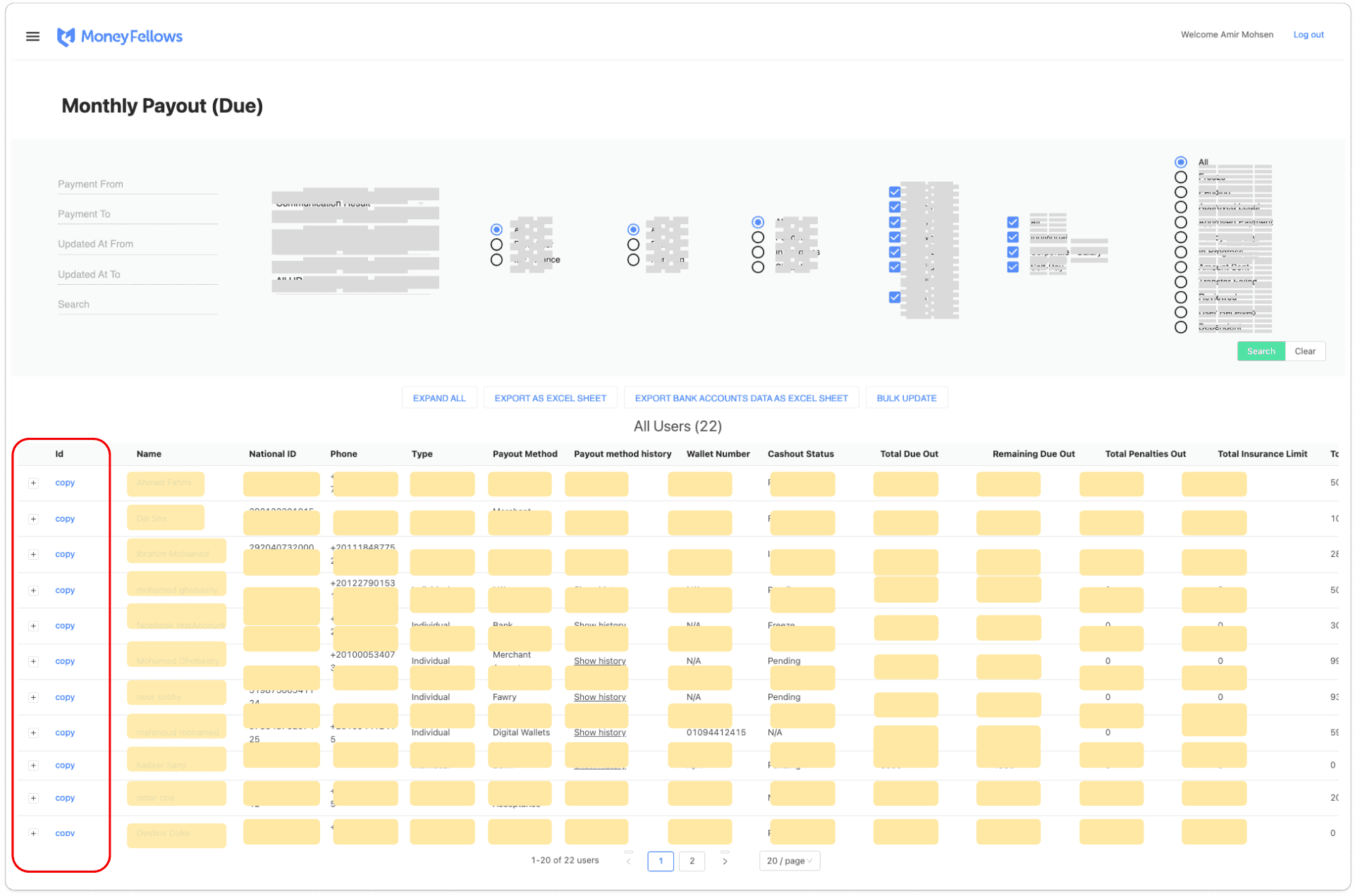

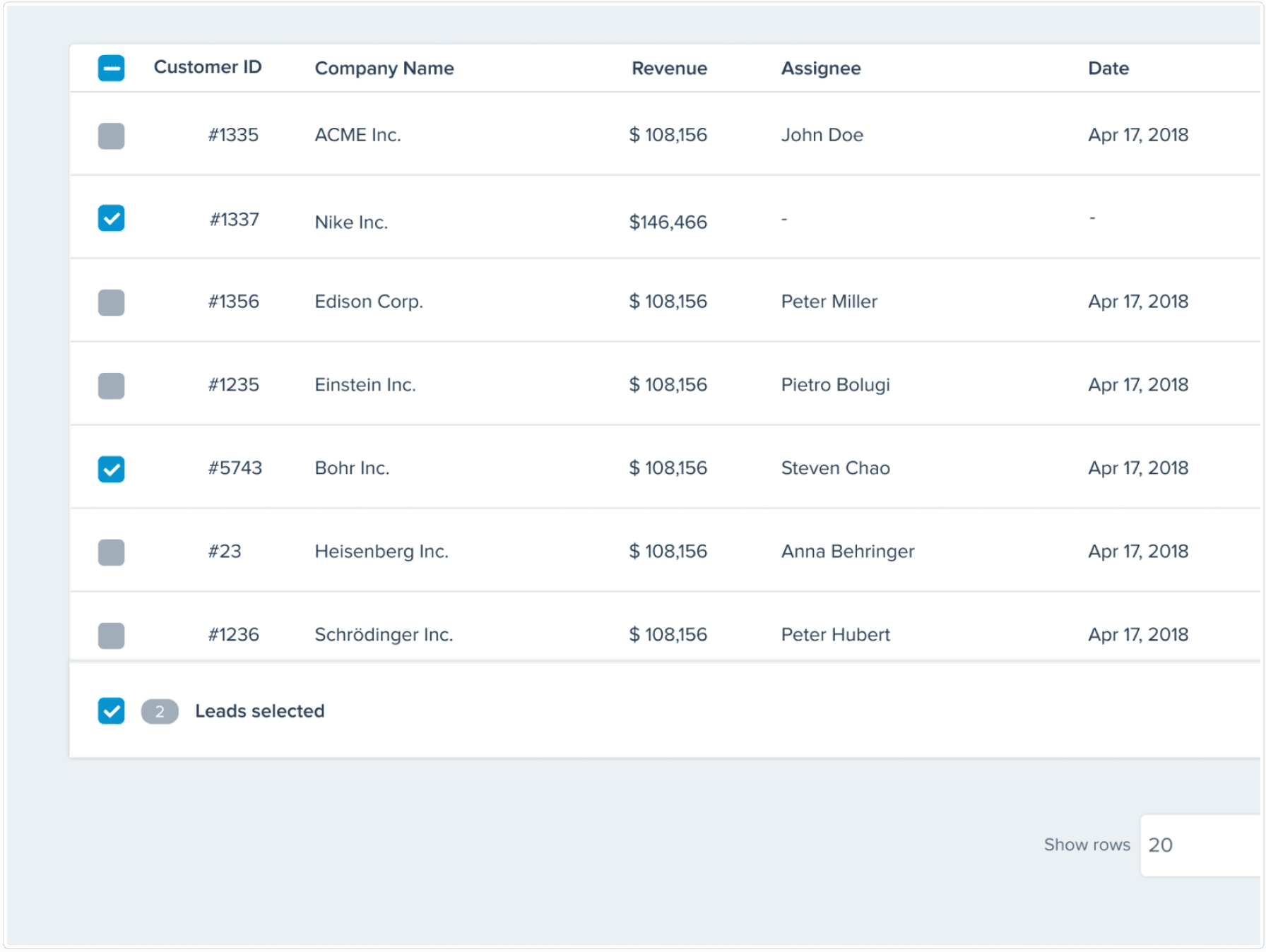

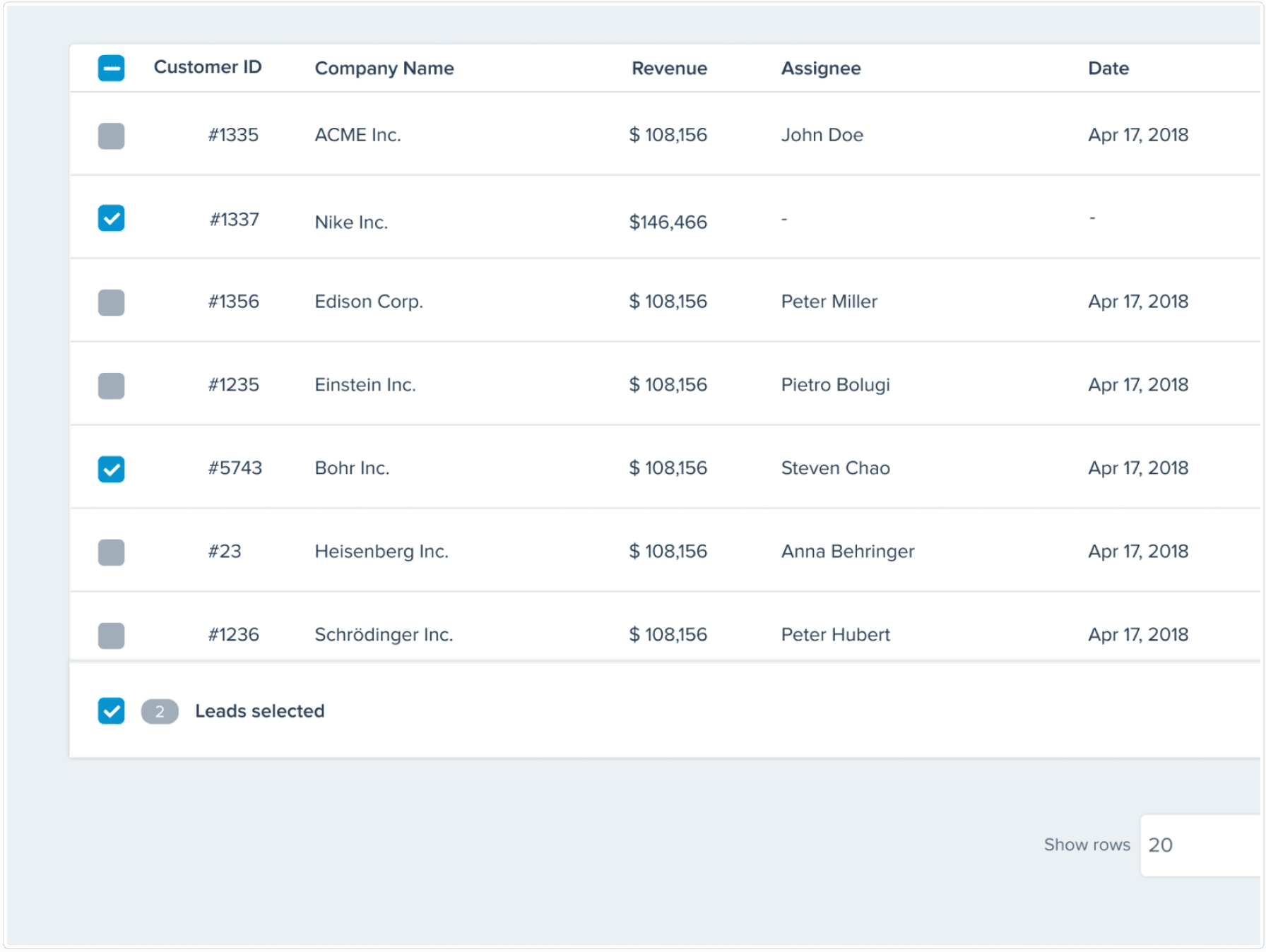

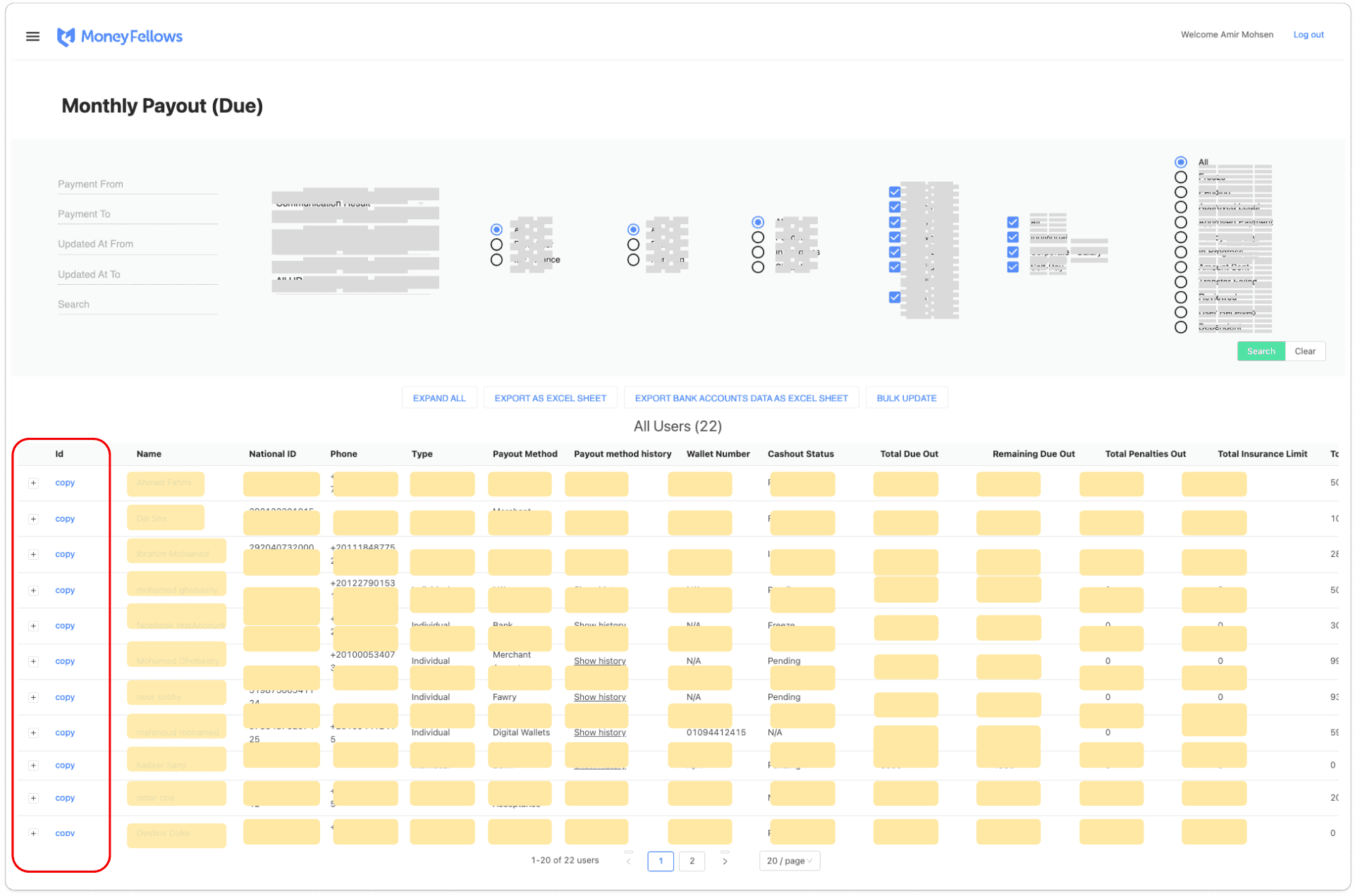

3- Bulk Update

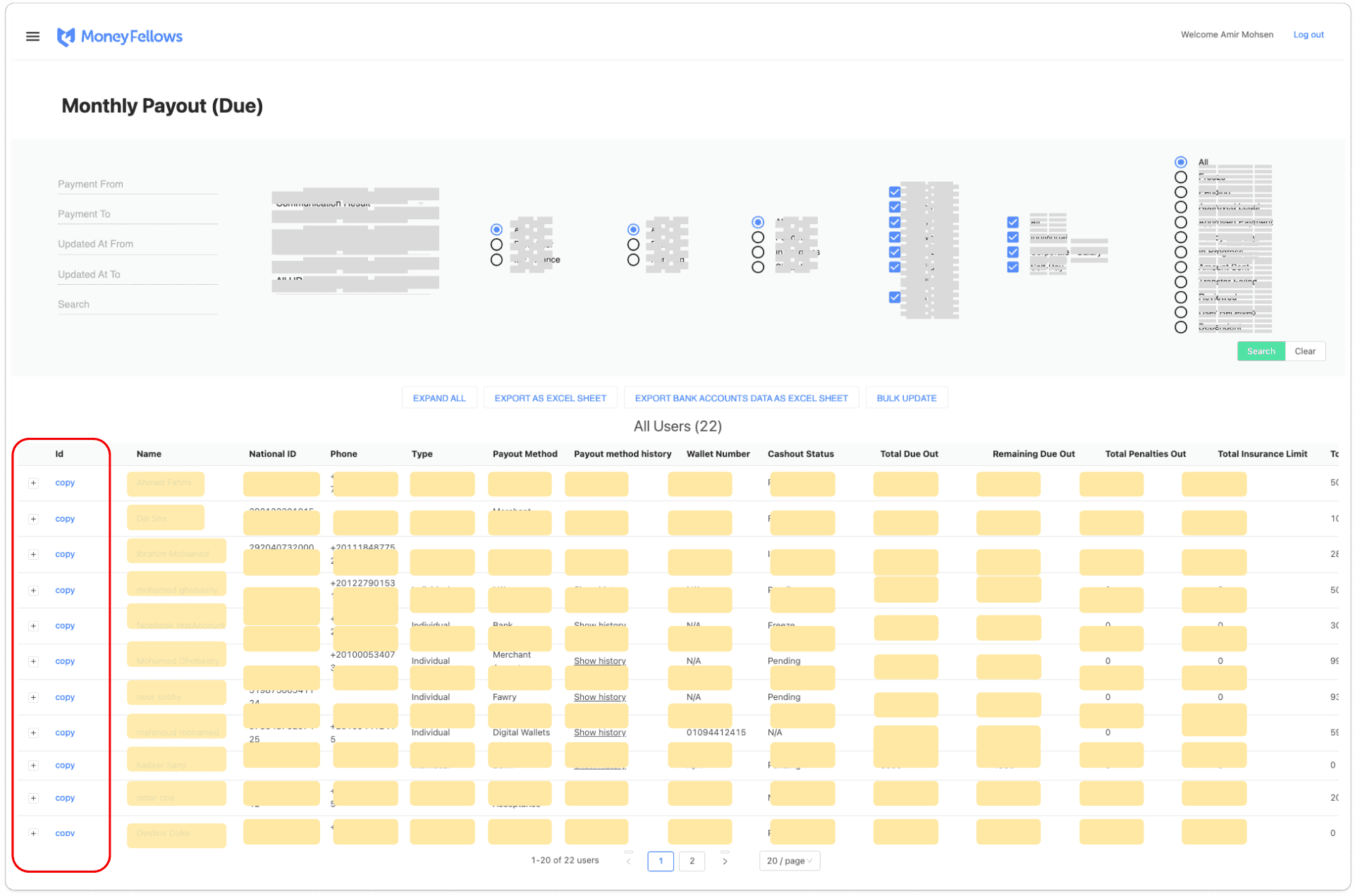

Normal Tables:

Our Admin Table:

I can’t share the solution due to privacy, as it is from our internal tools, but here is the flowchart of it.

Userflow:

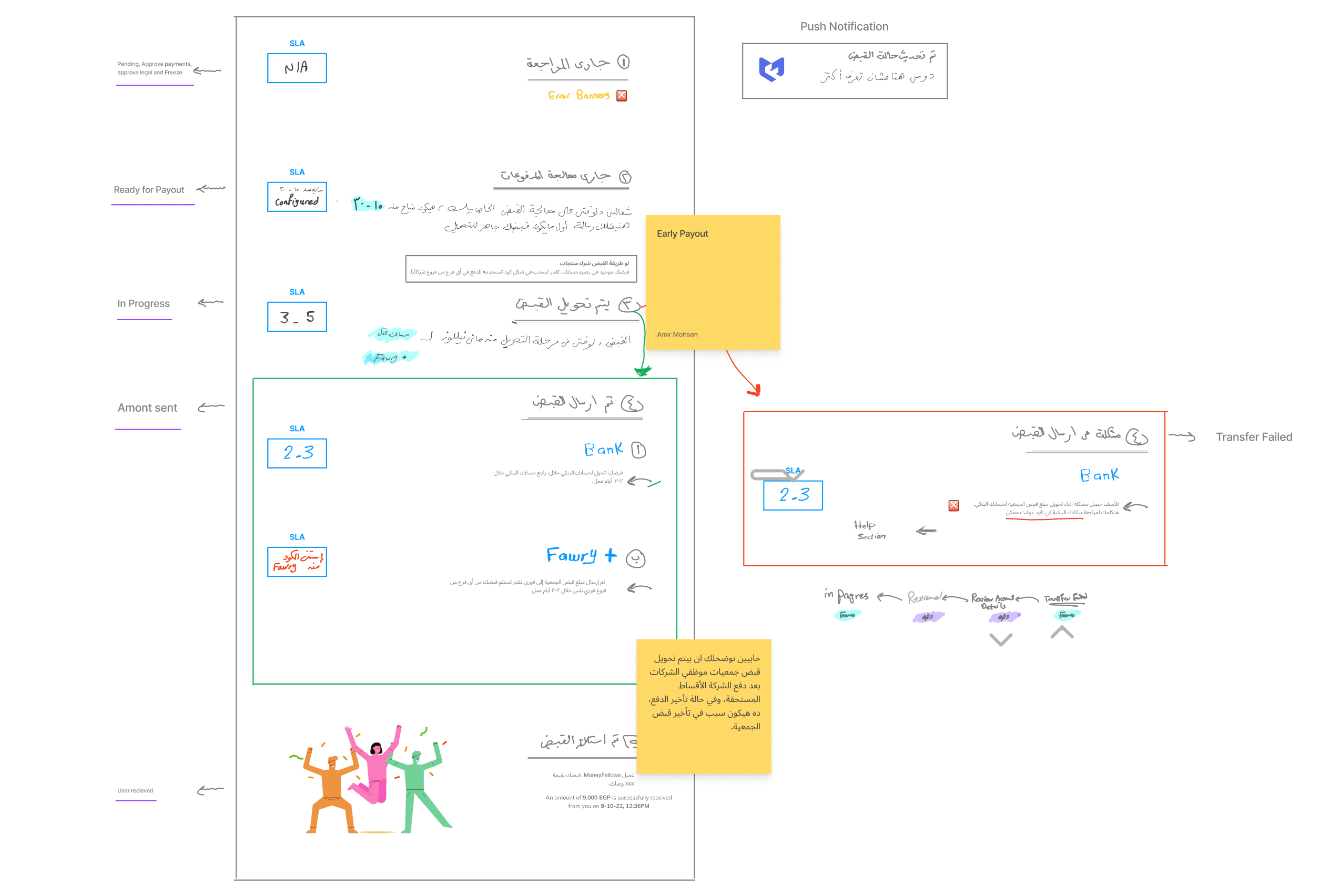

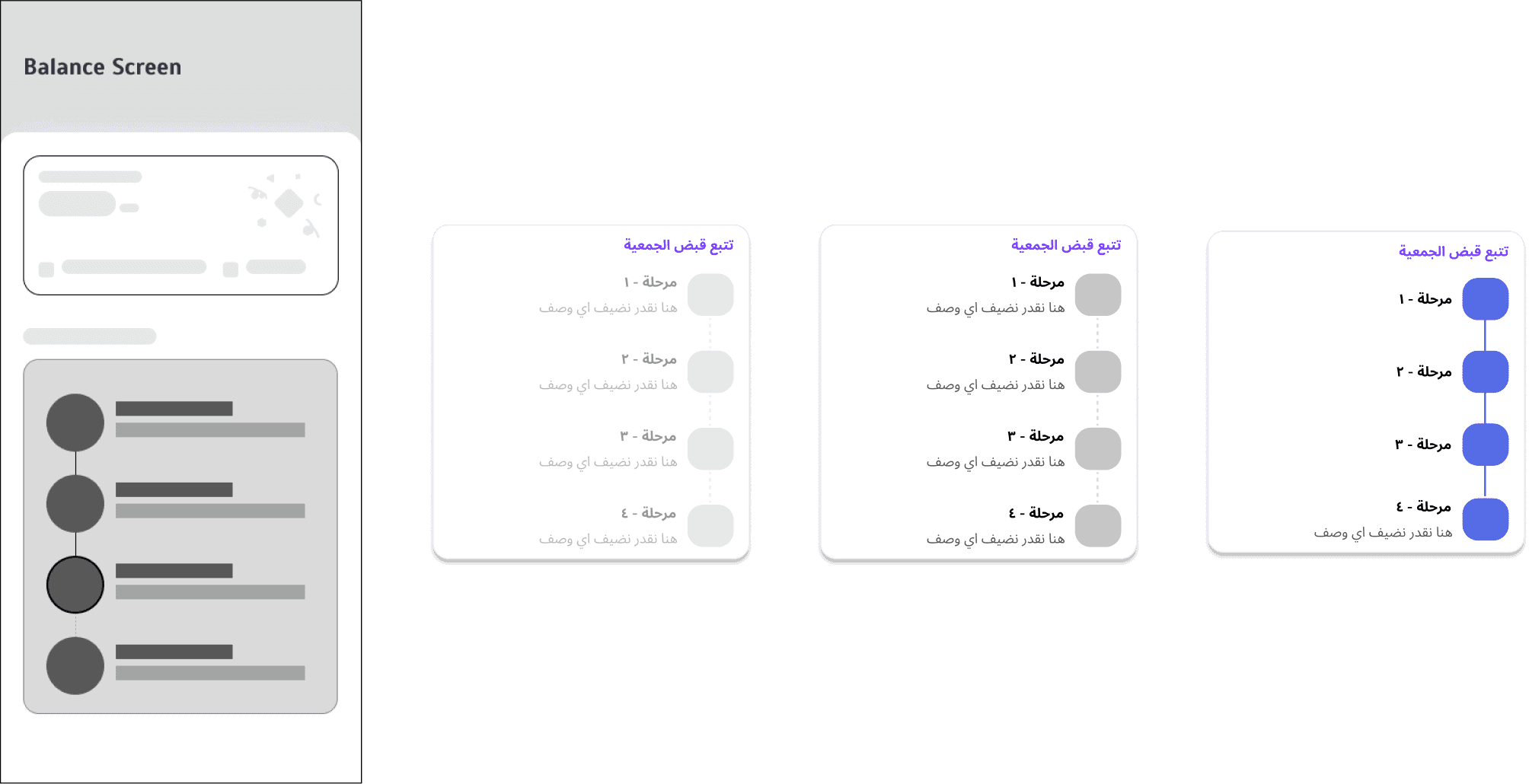

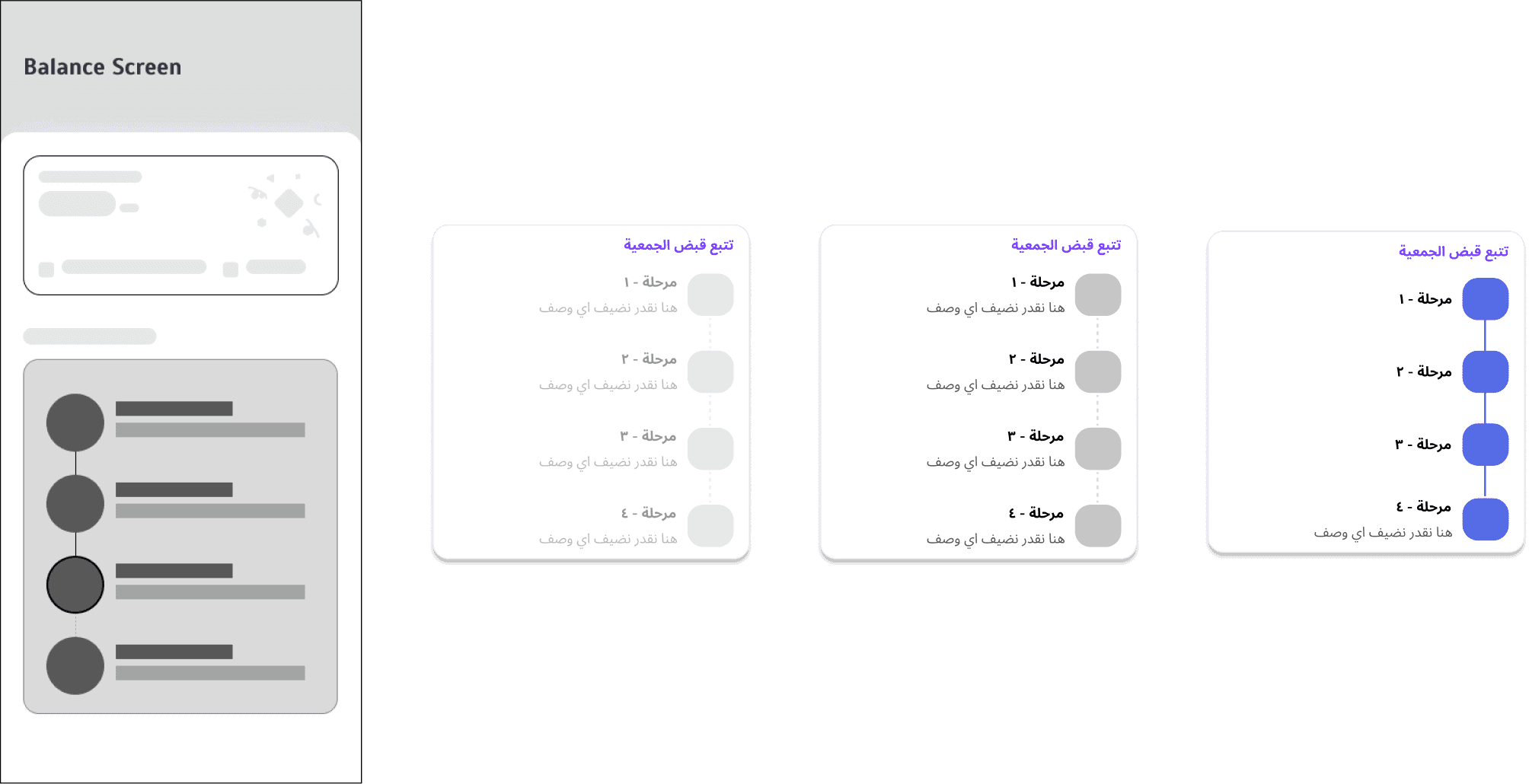

4- Payout Status Tracker

A payout status tracker for us will allow users to monitor the progress and status of payouts within their payout month. Here's a breakdown of its functionality and benefits:

Real-Time Updates: The tracker provides real-time updates on the status of upcoming payouts, whether it is pending, in progress, sent, or received.

Notifications: Users will receive notifications when payouts have been initiated, ensuring transparency and keeping them informed.

Payout Schedule Visualization: The tracker includes visual representations to illustrate the payout schedule and upcoming milestones, making it easier for user to predict when to receive their payout.

Overall, a payout status tracker enhances the user experience for Money Fellows users by providing transparency, accountability, and timely updates on the payout process, thereby increasing trust and confidence in our service.

Logic:

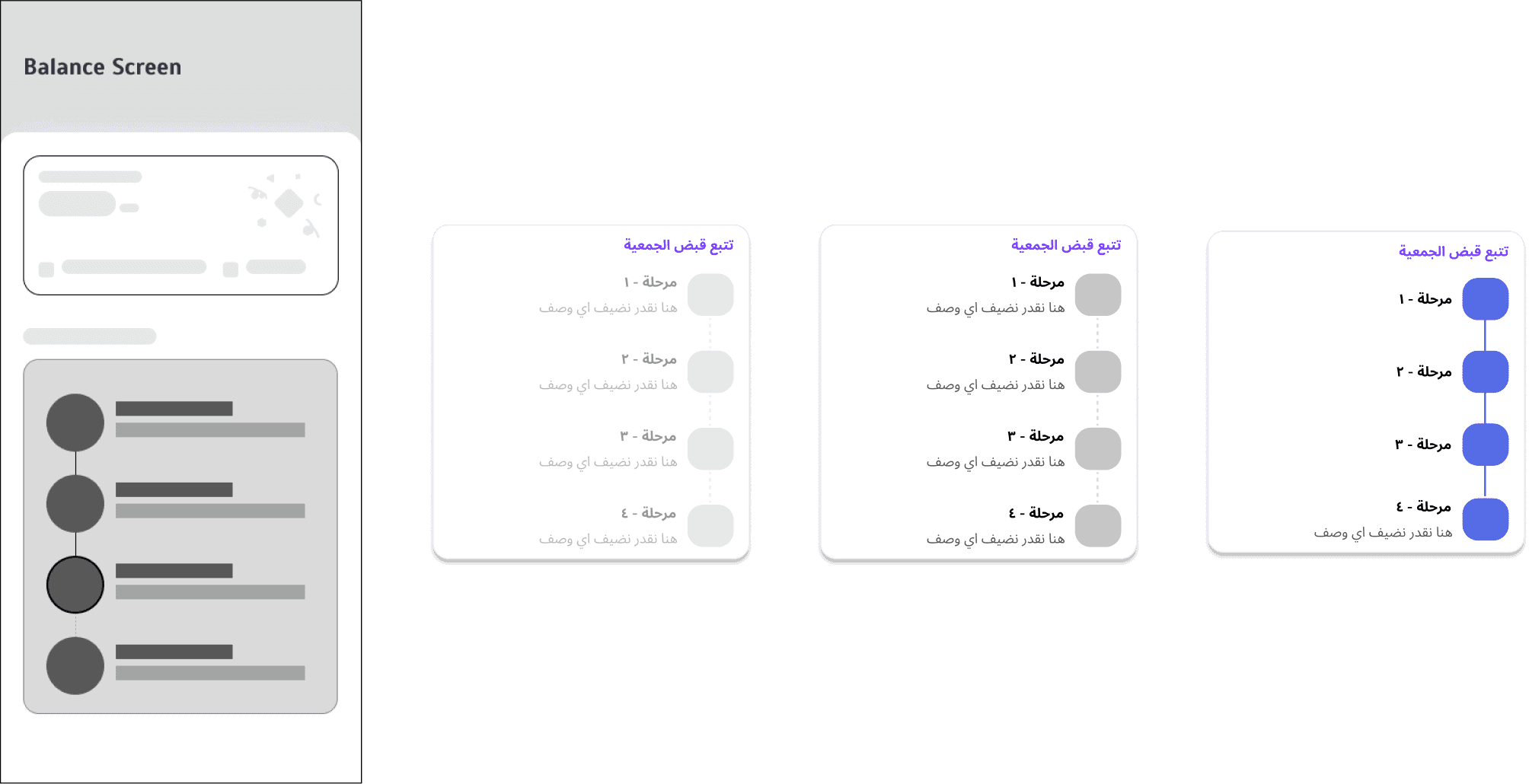

Wireframes:

User Interface:

Harvest Season:

Thank you!

— Enjoyed the Journey? Dive deeper into this design journey! If you're curious to explore the finer details or discuss the project further, feel free to >contact me<.

Context

Money Fellows is a financial technology (fintech) company based in Cairo, Egypt. It offers a platform that facilitates rotating savings and credit associations (ROSCAs), also known as "gameya" in Arabic. ROSCAs are traditional savings groups where members contribute fixed amounts of money regularly, and each member receives a lump sum payout in rotation.

Money Fellows aims to modernize and digitize the traditional ROSCA model, making it more convenient, transparent, and accessible to users through its online platform and mobile application. The platform allows users to create or join savings circles, contribute funds, and receive payouts according to a predetermined schedule. By leveraging technology

Problem

Users were complaining about their payout, and it’s date! As we can tell, the payout date isn’t well defined/specified, neither from the company, nor the contract.

Users are seeing this unfair to be requested to pay their pay-ins in their first 5 days of the month, and they receive

their money in the latest days in the month, I stand with our users on that!

Goal:

Increase users who are ready for payout at the first day of the month by 20%, the current number is 2% [May-July 2022]

-> Back then, Ameen - The Product Manager - has told me that we have technical limitations and we do a lot of manual work. We sat together and agreed on a plan to avail a status tracker and make the experience better on this aspect, we agreed that we need to tackle the following issues:

Plan (10-12 months):

Setting Expectations with clear communication through the app

Payout Automation Process that can automate most of the manual work

A faster and more effective way to let the operations payment team do their job

A status tracker to track the payment

Automate the finance process to include those who couldn’t receive their payout

Data Analysis:

As a product team we do like including the squad members early in the design process and the decision making process, that is even before the Squad playback or the Design Critique

We all agreed that the payout is the most critical point in our experience, we shared the plan with them, and we started moving forward

1- Setting Expectations with clear communication through the app

This has raised the awareness, and we started noticing people in the comments taking a screenshot

of the empty state and spread it out to let users that this normal and no need to panic

- The curve started to flatten and the spike in calls was gone already! ⭐️

2- Payout Automation Process

At that stage, the product team started thinking about having personas based on user behaviors, so we started creating Service Blueprint

This was super helpful in the payout automation process as it would show us the pain points and where can we automate some of our processes to enhance the payout experience

We have invested so much time on this, We had interviews with almost different departments, 3rd parties, banks and even couriers, this has taken almost a Quarter to finish the service blueprint in the Payments Squad

🛑 We have struggled with:

Trying to get available time slots with stakeholders

Sometimes, they even delegate the meeting to someone who isn’t up-to-date with the new process this has caused so much rework

Some updates were happening while we are interviewing some others

🍀 But we tried to be proactive, and learn from our mistakes, we also documented everything so we can update ourselves and the requirements to stay on track.

I will include the service blueprint for the payout process only, but I have worked on each flow in my scope, Here’ you can find the whole as-is scenario for the payout:

Before:

After:

I relied on the usability heuristics while designing the solution!

Wireframes & UI:

Data Tracking Events [Added] ✅

Prototyping & Testing:

Some minor changes have appeared in the usability tests, and we applied them to launch 🚀

We started seeing results!

Number of users who are ready to cashout at the 1st day of the month has increased from 2% to 39%!

3- Bulk Update

Normal Tables:

Our Admin Table:

I can’t share the solution due to privacy, as it is from our internal tools, but here is the flowchart of it.

Userflow:

4- Payout Status Tracker

A payout status tracker for us will allow users to monitor the progress and status of payouts within their payout month. Here's a breakdown of its functionality and benefits:

Real-Time Updates: The tracker provides real-time updates on the status of upcoming payouts, whether it is pending, in progress, sent, or received.

Notifications: Users will receive notifications when payouts have been initiated, ensuring transparency and keeping them informed.

Payout Schedule Visualization: The tracker includes visual representations to illustrate the payout schedule and upcoming milestones, making it easier for user to predict when to receive their payout.

Overall, a payout status tracker enhances the user experience for Money Fellows users by providing transparency, accountability, and timely updates on the payout process, thereby increasing trust and confidence in our service.

Logic:

Wireframes:

User Interface:

Harvest Season:

Thank you!

— Enjoyed the Journey? Dive deeper into this design journey! If you're curious to explore the finer details or discuss the project further, feel free to >contact me<.

Context

Money Fellows is a financial technology (fintech) company based in Cairo, Egypt. It offers a platform that facilitates rotating savings and credit associations (ROSCAs), also known as "gameya" in Arabic. ROSCAs are traditional savings groups where members contribute fixed amounts of money regularly, and each member receives a lump sum payout in rotation.

Money Fellows aims to modernize and digitize the traditional ROSCA model, making it more convenient, transparent, and accessible to users through its online platform and mobile application. The platform allows users to create or join savings circles, contribute funds, and receive payouts according to a predetermined schedule. By leveraging technology

Problem

Users were complaining about their payout, and it’s date! As we can tell, the payout date isn’t well defined/specified, neither from the company, nor the contract.

Users are seeing this unfair to be requested to pay their pay-ins in their first 5 days of the month, and they receive

their money in the latest days in the month, I stand with our users on that!

Goal:

Increase users who are ready for payout at the first day of the month by 20%, the current number is 2% [May-July 2022]

-> Back then, Ameen - The Product Manager - has told me that we have technical limitations and we do a lot of manual work. We sat together and agreed on a plan to avail a status tracker and make the experience better on this aspect, we agreed that we need to tackle the following issues:

Plan (10-12 months):

Setting Expectations with clear communication through the app

Payout Automation Process that can automate most of the manual work

A faster and more effective way to let the operations payment team do their job

A status tracker to track the payment

Automate the finance process to include those who couldn’t receive their payout

Data Analysis:

As a product team we do like including the squad members early in the design process and the decision making process, that is even before the Squad playback or the Design Critique

We all agreed that the payout is the most critical point in our experience, we shared the plan with them, and we started moving forward

1- Setting Expectations with clear communication through the app

This has raised the awareness, and we started noticing people in the comments taking a screenshot

of the empty state and spread it out to let users that this normal and no need to panic

- The curve started to flatten and the spike in calls was gone already! ⭐️

2- Payout Automation Process

At that stage, the product team started thinking about having personas based on user behaviors, so we started creating Service Blueprint

This was super helpful in the payout automation process as it would show us the pain points and where can we automate some of our processes to enhance the payout experience

We have invested so much time on this, We had interviews with almost different departments, 3rd parties, banks and even couriers, this has taken almost a Quarter to finish the service blueprint in the Payments Squad

🛑 We have struggled with:

Trying to get available time slots with stakeholders

Sometimes, they even delegate the meeting to someone who isn’t up-to-date with the new process this has caused so much rework

Some updates were happening while we are interviewing some others

🍀 But we tried to be proactive, and learn from our mistakes, we also documented everything so we can update ourselves and the requirements to stay on track.

I will include the service blueprint for the payout process only, but I have worked on each flow in my scope, Here’ you can find the whole as-is scenario for the payout:

Before:

After:

I relied on the usability heuristics while designing the solution!

Wireframes & UI:

Data Tracking Events [Added] ✅

Prototyping & Testing:

Some minor changes have appeared in the usability tests, and we applied them to launch 🚀

We started seeing results!

Number of users who are ready to cashout at the 1st day of the month has increased from 2% to 39%!

3- Bulk Update

Normal Tables:

Our Admin Table:

I can’t share the solution due to privacy, as it is from our internal tools, but here is the flowchart of it.

Userflow:

4- Payout Status Tracker

A payout status tracker for us will allow users to monitor the progress and status of payouts within their payout month. Here's a breakdown of its functionality and benefits:

Real-Time Updates: The tracker provides real-time updates on the status of upcoming payouts, whether it is pending, in progress, sent, or received.

Notifications: Users will receive notifications when payouts have been initiated, ensuring transparency and keeping them informed.

Payout Schedule Visualization: The tracker includes visual representations to illustrate the payout schedule and upcoming milestones, making it easier for user to predict when to receive their payout.

Overall, a payout status tracker enhances the user experience for Money Fellows users by providing transparency, accountability, and timely updates on the payout process, thereby increasing trust and confidence in our service.

Logic:

Wireframes:

User Interface:

Harvest Season:

Thank you!

— Enjoyed the Journey? Dive deeper into this design journey! If you're curious to explore the finer details or discuss the project further, feel free to >contact me<.

Service Design User Experience User Interface

Service Design User Experience User Interface

Service Design User Experience User Interface

Payout Automation Journey

Payout Automation Journey

Payout Automation Journey